Financial Sector Participants Directory - Bank. Mindful of the speed and scale of response required MERCY Malaysia is launching the MERCY Malaysia India COVID-19 Fund to help them contain this human catastrophe.

Hati Toy Together Old And Young Is A National Inter Generational Community Charity Project Aimed To Improve Mental Health Among Underprivileged Children And Youth Cay Through Expressive Art Facilitated By Trained

Malaysia COVID-19 Charity Drive.

. Gift of money to the Government State Government or Local Authorities. Gift of money to Approved Institutions or Organisations. Amount is limited to 10 of aggregate income Subsection 446 3.

Sau Seng Lum is a leading non-profit health system in Malaysia. Cash donation paid to approved institutions or organisations Gift of money orcontiibutioninLkino to any sports activity or approved 700 OF sports body Gift of. Based on the revised guidelines the donor is required to provide complete information of the details stipulated below in order to obtain an official receipt or tax-exemption receipt from the.

Subsection 44 6 2. Tuesday August 2 2016 1016 IST. A list of institutions where donations are eligible for tax benefits under SEC 80G.

Ahmad has an aggregate income of RM60000 and makes a donation of RM5000 to an approved institution. Gift of money to Approved Institutions or Organisations. Gift of money or cost of contribution in kind for any Approved.

Amount is limited to 7 of aggregate. The dgir gazettes the name of the institution or organization in the government gazette after the application is approved. Institution or organisation or fund approved under subsection 446 of the ITA 1967.

HCM City Traditional Medicine Institute wins Labour Order award. List of approved institution for donation in malaysia. Been approved under subsection 44 6 of the ita.

Donations are only tax deductible if they are made to a Government approved charitable organisation or directly to the Government. Should an approved institution or organisation or fund reapply for the purpose of contribution. Heres quick scenario to briefly illustrate how the whole thing works.

GCP accreditation from the Ministry of Health at the event. Any organisation or institution which is approved under subsection 446 will automatically be granted tax exemption on its income except dividend income under. The centre has been continuing its mission to provide subsidised haemodialysis service to the underprivileged.

Allocate funds to provide frontliners with face masks COVID-19 test kits and more ventilators to be used by patients in. And you must keep the receipt of the. Donations are only tax deductible if they are made to a Government approved charitable organisation or directly to the Government.

Happy Bank is a non-profit volunteer-based organisation that is driven by youths of all backgrounds with the aim to support and help the underprivileged and. The charitable institution organisation must spend at least 50 or such percentage as may be determined by the Director General of its income including donation received in the previous.

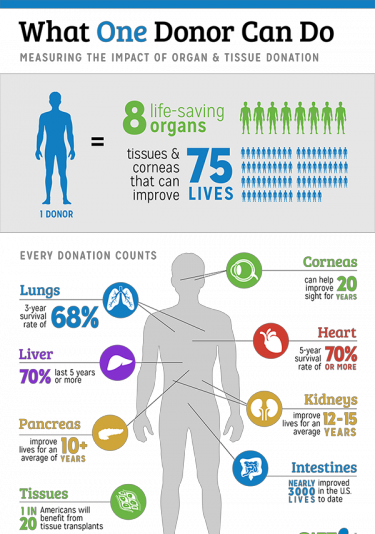

Pdf Organ Donation And Transplantation Awareness Attitude And Aptitude Of The Unikl Rcmp Students Malaysia

Regulatory Requirement For Npos In Malaysia Download Table

Updated Guide On Donations And Gifts Tax Deductions

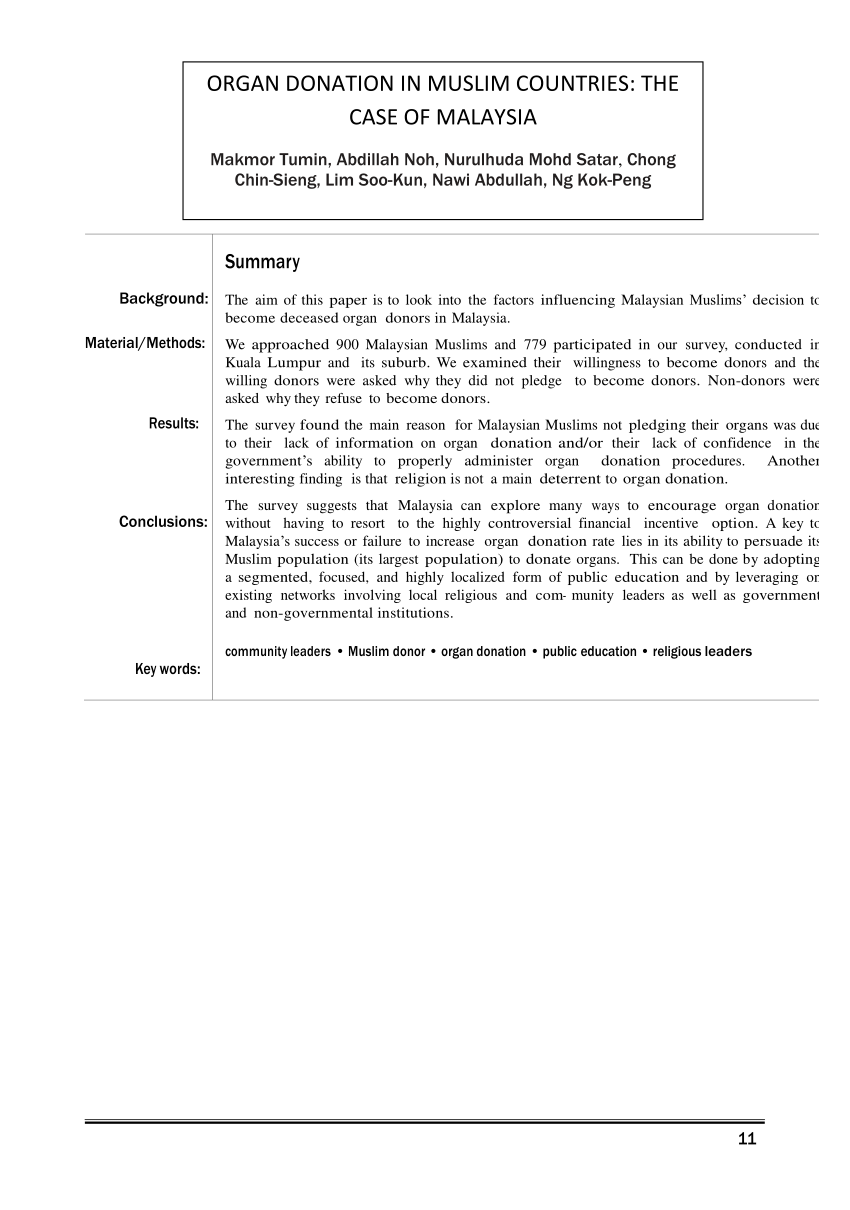

Pdf Organ Donation In Muslim Countries The Case Of Malaysia

Support Our Programmes Mercy Malaysia

Unhcr Direct Debit Donor Programme

Rakyatjagarakyat White Flag Initiatives And Food Aids In Malaysia To Support Buro 24 7 Malaysia

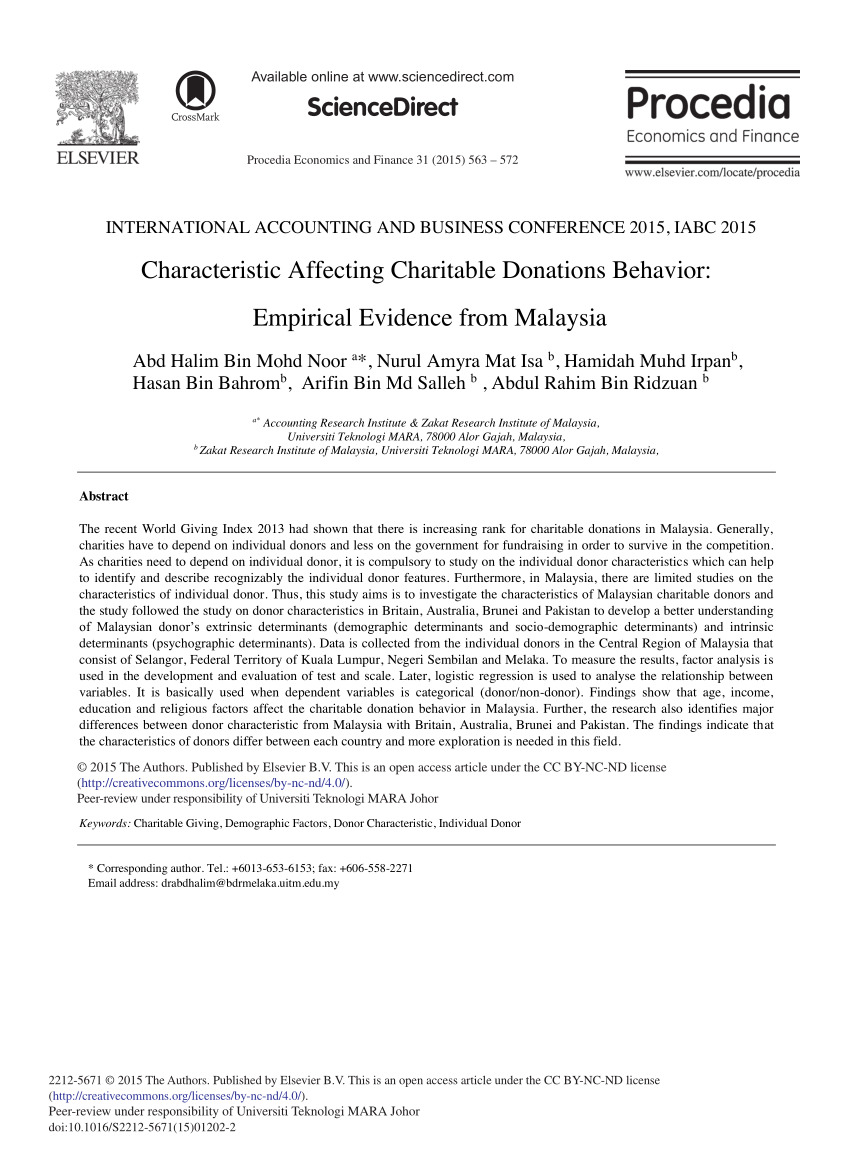

Pdf Characteristic Affecting Charitable Donations Behavior Empirical Evidence From Malaysia

Regulatory Requirement For Npos In Malaysia Download Table

Why Are There So Many Liver Transplants From Living Donors In Asia And So Few In Europe And The Us Journal Of Hepatology

It Ll Be Nice To Help Someone Even After I Ve Passed On Mps Young Pharmacist Chapter

Muet Session 3 Opening Registration Please Take Note Of The Opening And Closing Dates For Muet Exam Registration And T English Test Exam Grab The Opportunity

J O S E P H S M Organ Donation Campagin Poster College Project Organ Donation Donate Life Living Kidney Donation

5 Key Facts You Probably Didn T Know About Tax Deductibles In Malaysia

Simplygiving Online Fundraising Crowdfunding Across Asia

Knowledge And Attitude Towards Organ Donation Among Adult Population In Al Kharj Saudi Arabia

St Partners Plt Chartered Accountants Malaysia Donations And Gifts Allowable Deduction From Aggregate Income Please Take Note That Not All Donations Gifts Provided Are Entitled For The Tax Deduction